Welcome to Z-Guides, where we take the daunting world of credit and make it as approachable as a cozy cup of coffee on a chilly day. Over a series of 8 blogs, we're going to break down everything you need to know about credit, from the basics to the nitty-gritty details.

Whether you're a seasoned credit card pro or just starting on your credit journey, this is Credit Education 101 - and we're here to guide you through it. This blog takes you through a crash course on credit scores, how they’re calculated, and how you can improve your score.

So grab a seat, get comfortable, and let’s dive into the world of credit together.

What is a credit score?

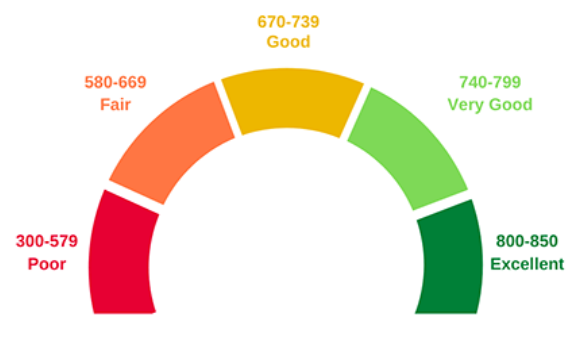

Your credit score is like your report card for adulting, with a number from 300 to 850 that tells lenders how responsible you are with credit.

It not only determines your creditworthiness but also affects your ability to obtain loans, credit cards, or even rent an apartment. It is like your financial GPA, but you must pay your bills on time instead of studying and keep your debt low.

Your FICO® Score is a three-digit number, usually between 300 to 850, based on metrics developed by Fair Isaac Corporation.

How is your credit score calculated?

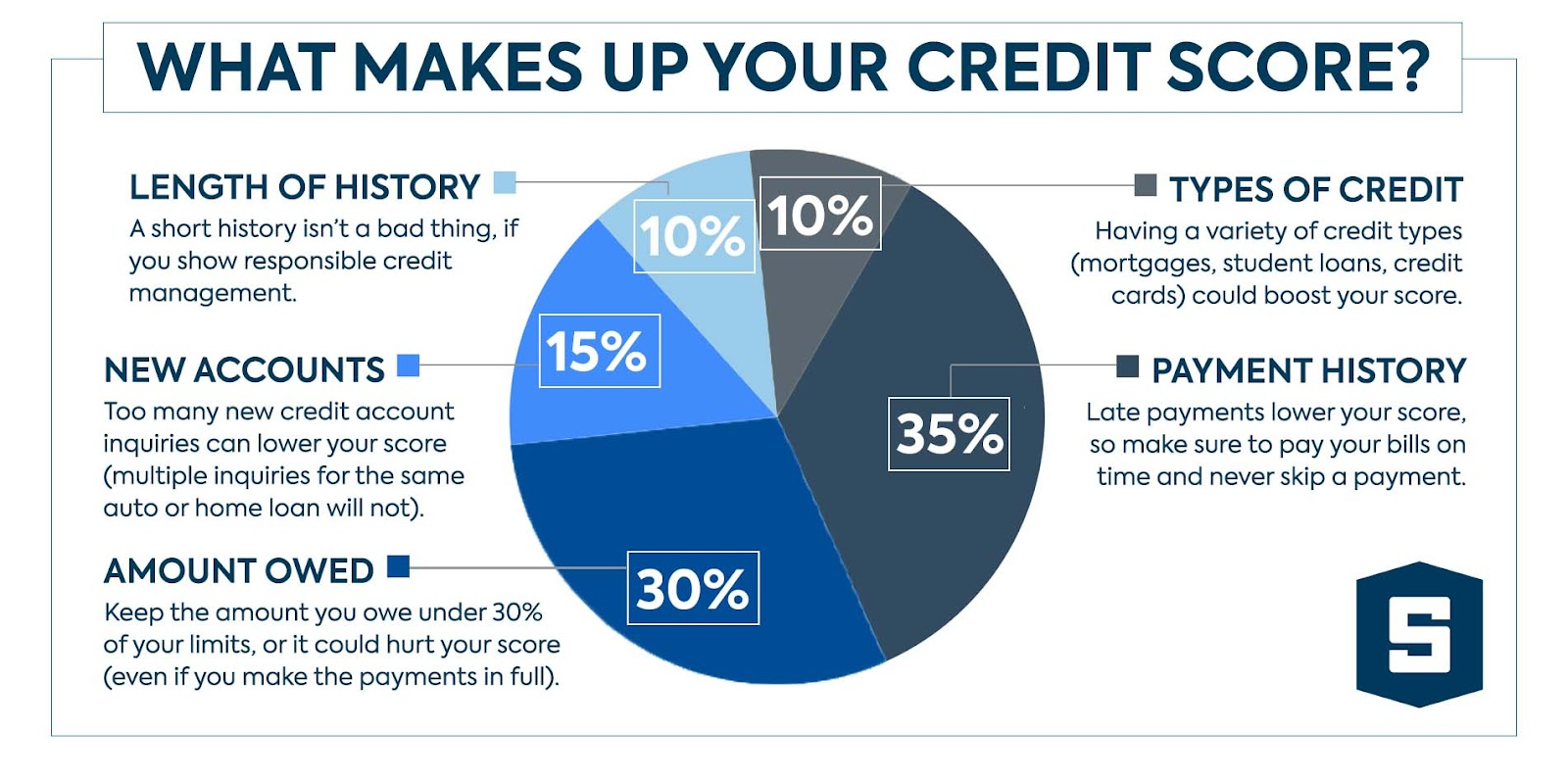

Here are the 5 pieces that make up a credit score:

- Payment history: This is the most important factor in determining your credit score, accounting for 35% of the total score. Lenders want to know if you pay your bills on time, as missed or late payments can negatively impact your score. Even one missed payment can stay on your credit report for up to seven years. Hence, staying current on all bills is essential.

- Credit utilization: This is the amount of credit you're using compared to your credit limit. It accounts for 30% of your credit score. Using too much credit can indicate that you may be overextended and at a higher risk of defaulting on payments. Experts recommend keeping your credit utilization below 30%.

- Length of credit history: This factor accounts for 15% of your credit score. Lenders want to see that you have a long credit history, as it shows that you have a proven track record of responsible credit use. This is why it's important to establish credit early on, even if it's just a small credit card with a low limit.

- Credit mix: This accounts for 10% of your credit score. Lenders want to see that you have a mix of credit types, such as credit cards, mortgages, and car loans. This shows that you can handle different types of credit responsibly.

- New credit: This accounts for the final 10% of your credit score. Lenders want to see that you're not taking on too much new credit at once, as it can indicate financial instability or desperation. Every time you apply for new credit, it can impact your score, so it's important only to apply when necessary.

Want to read up more? Here are some resources on credit scores.

If you want to learn more about credit scores, here are some places to start:

Read Up Enough? Time to Take Action!

Now that you understand credit scores better, it's time to take action. Here are some steps to improve your credit score:

- Consider setting up Autopay on your Zolve app and never miss a payment.

- Keeping your credit utilization rate below 30% may help you maximize your credit score.

- Use an online calculator to check your debt-to-income ratio, which helps determine how much credit you can take on.

- Create an emergency fund. Learn how to pay yourself first and better prepare for the unexpected.

- Practice clearing out payments before taking on new debt. Keep track of all your spends insightfully under Spend Analytics on the Zolve app. (Android & iOS)

- Consider ordering a credit report once a year. Requesting your credit report will never affect your score.

- Track your credit score regularly under the Credit Score Tracker on the Zolve app.

- Think twice before closing your accounts. Keeping accounts active will also help you build the length of your credit file, which makes up 15% of your FICO Score.

Next in the Z-Guides series: Why building a good credit score matters. Stay tuned!

Disclaimer: The products, services, and offerings mentioned in this blog are subject to change and may vary over time. We recommend visiting our official website for the most up-to-date information on Zolve's offerings.